2 2 Define, Explain, and Provide Examples of Current and Noncurrent Assets, Current and Noncurrent Liabilities, Equity, Revenues, and Expenses Principles of Accounting, Volume 1: Financial Accounting

Even licenses and permits fall into the category of intangible non-current assets. Your current assets are taxed as revenue when you sell them, and you pay corporate income tax. From the above, we can see that land is not subject to depreciation.

Allegion (NYSE: ALLE) Reports Q2-2023 Financial Results – InvestorsObserver

Allegion (NYSE: ALLE) Reports Q2-2023 Financial Results.

Posted: Wed, 26 Jul 2023 09:31:36 GMT [source]

It’s important because it indicates whether or not a company is likely to stay in operation in the future. A financial professional will offer guidance based on the information provided and offer a no-obligation call to better understand your situation. They typically have a life of more than one year and are not intended for resale. If goodwill is believed to be less valuable than it was at the time of the acquisition, it will be written down to its current fair value. Goodwill impairment is a non-cash expense and is often added back to normalized earnings and/or EBITDA when analyzing a company.

Join PRO or PRO Plus and Get Lifetime Access to Our Premium Materials

Let’s now turn our attention to how NCA are recorded when a business purchases a NCA. Noncurrent Assets are written off throughout the course of their useful lives in order to spread out their expense. Noncurrent Assets are only depreciated to spread out the cost of the asset over time rather than to represent a new value or a replacement value. Marketable securities include assets such as stocks, Treasuries, commercial paper, exchange traded funds (ETFs), and other money market instruments. Let’s continue our exploration of the accounting equation, focusing on the equity component, in particular.

- As opposed to non-current assets, current assets are widely considered to be a short-term investment.

- Some common NCA are land, buildings, equipment, furniture and fixtures and vehicles.

- The short-term debt of an organization may be settled with cash and equivalents (that may be converted).

This value could come in the form of customer lists, brand recognition, intellectual property, or even projected cost savings (often referred to as “synergies”). Under most accounting frameworks, including both US GAAP and IFRS, Investments are generally held at purchase price (known as book value) on a company’s balance sheet. Changes in book value are recorded as gains or losses at the time of disposition.

practice questions

For example in 2022 Westfarmers reported $3621 million in Property, Plant and Equipment, and in the accompanying note 8, accumulated depreciation is reported under each depreciable non-current asset. Over time as the asset is used to generate revenue, the business will need to depreciate the asset. Depreciation, or the expensing of NCA is the process of allocating the cost of a NCA over its useful life, or the period of time that the business believes it will use the asset to help generate revenue.

Pyxis Tankers Announces Financial Results for the Three Months … – GlobeNewswire

Pyxis Tankers Announces Financial Results for the Three Months ….

Posted: Mon, 31 Jul 2023 12:00:00 GMT [source]

We want to clarify that IG International does not have an official Line account at this time. We have not established any official presence on Line messaging platform. Therefore, any accounts claiming to represent IG International on Line are unauthorized and should be considered as fake.

You can also optimize your asset portfolio using historical data and actual efficiency, broken down by asset type. You can all too easily record lost, damaged, or stolen assets in your business’s books. Putting an asset management plan in place gives you an accurate view of the value of your assets at all times so you can make more informed decisions. Your non-current assets are taxed as capital when you sell them, and you pay capital gains tax. The main difference between non-current and current assets is longevity.

What Are Some Real-Life Examples Of Current And Noncurrent Assets?

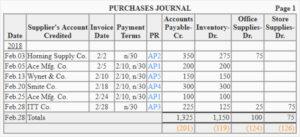

Plus, given the importance of these concepts, it helps to have an additional review of the material. In this scenario, the depreciation expense for the machine is £180,000. This is calculated by taking the final value from the initial value, and dividing the result by the lifespan of the asset ([£2 million – £200,000] divided by 10). At the end of the purchases journal machine’s useful life, it will be accounted for by the company using the salvage value of £200,000. When a business purchases a NCA (used for more than one year), it classifies the asset based on whether the asset is used in the business’s operations. If a NCA is used in the business operations, it will belong in property, plant, and equipment.

When running a business, it’s always smart to keep a keen eye on the future. A business asset is any item or resource that your business owns, has a monetary value, and helps the business function. Assets differ from business to business depending on what those businesses do, how they operate, and their position in the supply chain.

The Difference Between Current and Noncurrent Assets

It generates when the price that is paid for the company goes over the fair value of all of the identifiable assets and liabilities. Noncurrent assets are aggregated into several line items on the balance sheet, and are listed after all current assets, but before liabilities and equity. You can value non-current assets by subtracting the accumulated depreciation from their purchase price. Regardless of the NCA being depreciated, the general form of the entry is the same – depreciation expense and accumulated depreciation is increased.

The concept of equity does not change depending on the legal structure of the business (sole proprietorship, partnership, and corporation). The terminology does, however, change slightly based on the type of entity. For example, investments by owners are considered “capital” transactions for sole proprietorships and partnerships but are considered “common stock” transactions for corporations. Likewise, distributions to owners are considered “drawing” transactions for sole proprietorships and partnerships but are considered “dividend” transactions for corporations.

What Are Non-Current Assets?

When recording an asset, the total cost of acquiring the asset is included in the cost of the asset. This includes additional costs beyond the purchase price, such as shipping costs, taxes, assembly, and legal fees. For example, if a real estate broker is paid $8,000 as part of a transaction to purchase land for $100,000, the land would be recorded at a cost of $108,000. Accurate financial records give a clear view of your company’s current financial status and help you make better decisions and avoid financial surprises.

It is helpful to also think of net worth as the value of the organization. Recall, too, that revenues (inflows as a result of providing goods and services) increase the value of the organization. So, every dollar of revenue an organization generates increases the overall value of the organization. IG International Limited is licensed to conduct investment business and digital asset business by the Bermuda Monetary Authority.

Investments are classed as non-current only if they are not expected to yield a profit or generate cash for a company within a 12-month period. A company’s solvency is its ability to meet its short-term and long-term debts and thus, continue to operate. Assets minus liabilities is a quick calculation for determining solvency.

Depreciation only applies to those assets with limited useful lives, i.e. the asset’s revenue generating ability is limited by wear and tear and/or obsolescence. As land has an unlimited useful life, depreciation is not applied to it. One way to determine a company’s solvency is the current ratio, which is a financial ratio gleaned from the balance sheet. It could take several months or even over a year to sell a fixed asset for cash. Property, plant, and equipment, such as a factory, are examples of fixed assets.